Closing a Limited Liability Partnership

An Overview of Closing a Limited Liability Partnership

The Limited Liability Partnership (LLP), which is not carrying on its business since its incorporation or which has terminated/stopped carrying on its business for a period of one year or more, can apply to the Registrar for its closure and also for removal of its name from the Register of the LLPs. If the LLP has turned dormant, then it is better to close it than fulfilling all the compliances, and it is also better to close than pay a fine or penalty in case the LLP is inactive.

Conditions under which a Limited Liability Partnership can be closed:

- It is not active since the date of its incorporation or for at least one year

- It does not have any asset/liability on the date of application

- The current account of LLP has been closed.

- Consent of all the parties, such as a creditor, authority or partner, has been obtained.

Reasons for the closing of Limited Liability Partnership:

- When the LLP is registered for a specific purpose, and the purpose is complete.

- The LLP has become insolvent.

- When the LLP is not active for at least one year.

- The court has ordered the closing of LLP.

- The partners of the LLP are not interested in continuing the partnership.

- If, after the death of another partner/partners, the one who is alive wants to close the LLP.

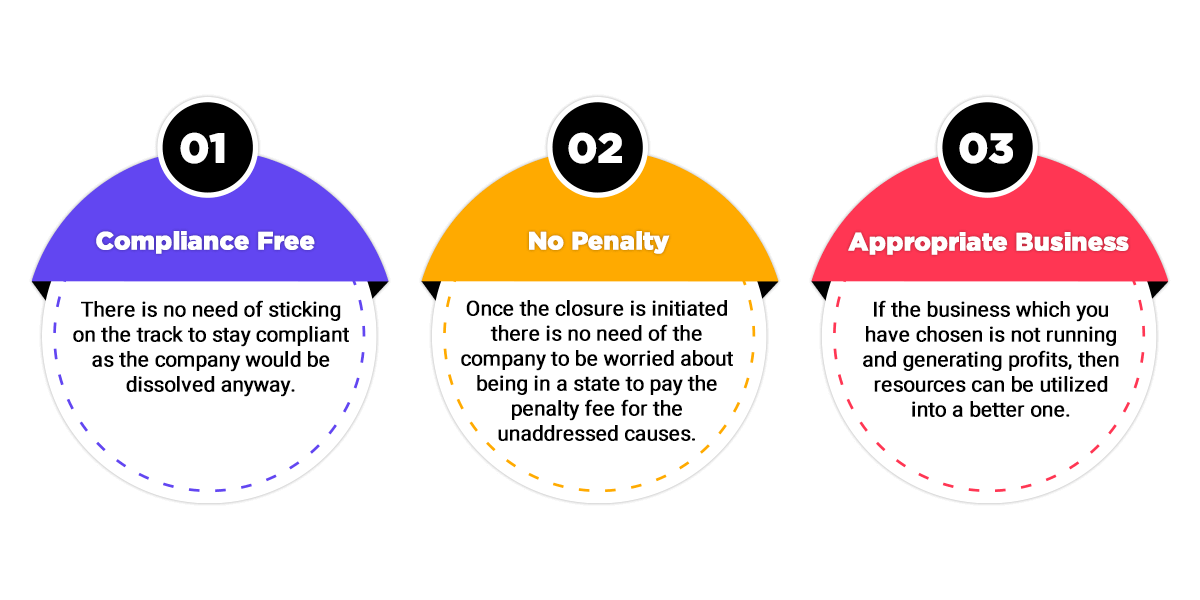

Benefits of Closing an LLP

Documents Required to Close an LLP

An application is required to be made in e-Form 24 to remove the name of the LLP, including the followings:

- Address Proof of LLP

- NOC from the landlord (If the registered office place is rented, rent agreement & one utility bill (water bill, electricity bill, property tax bill, gas receipt etc.)

- A statement of accounts revealing NIL assets & NIL liabilities, made up to a date not earlier than thirty days of the date of filing of Form 24 certified by a Chartered Accountant in practice.

- Copy of acknowledgement of latest ITR- Self Explanatory

- Copy of the initial LLP agreement, along with changes thereof if entered into and not filed,

- An affidavit signed by the designated partners of LLP, either jointly/severally, to the effect: –

- That the Limited Liability Partnership has not commenced business or where it commenced business, it ceased to carry on such business.

- That Limited Liability Partnership has no liabilities and indemnifies any liability that may arise even after striking off its name from the Register.

- That the Limited Liability Partnership has not opened any Bank Account and where it had opened, the said bank account has since been closed together with certificate(s) or statement from the respective bank demonstrating closure of Bank Account;

- That the LLP has not filed any Income-tax return where it has not carried on any business since its incorporation, if applicable.

- NOC from Creditors: – NOC for strike-off to be obtained from secured creditors & Partners if any

- Copy of Detailed Application- Mention full details of LLP plus reasons for closure

- Copy of Authority to Make the Application- Duly signed by all the Partners

- Indemnity Bond: –

- The application in the form as may be prescribed must be accompanied by an Indemnity Bond given by each designated partner duly notarized about the liabilities that even after the removal of the name of such LLP, the liabilities will be met.

- Indemnity Bond should be given on the Non-Judicial Stamp Paper of adequate value as applicable in the State where the Registered Office of the LLP is situated. Therefore, the text of the Indemnity Bond should be typed on the Non-Judicial Stamp Paper and then should be executed before the Public Notary

Before the introduction of the LLP (Amendment) Rules, 2017, the procedure for winding up an LLP used to be extended and burdensome. On the other hand, with its introduction and introduction of LLP E-Form 24, the procedure has been made simple and easy.

Procedure to Close Limited Liability Partnership

In case the LLP wants to close its business or where it is not carrying on any business activity for at least one year then it can apply to the Registrar for declaring it as defunct and removing its name from the Register.

Any LLP can close its business by adopting any of the following two ways:

A) Declaring Limited Liability Partnership as Defunct

In case the LLP desires to close its business or where it is not carrying on any business activities for one year or more, it can make an application to the Registrar for declaring the entity- LLP as defunct & eliminating the name of the LLP from its register of LLPs in India.

The e-Form 24 is requisite to be filed for striking off the name of LLP under clause (b) of sub-rule 1 of Rule-37 of LLP, Rules 2008. Correspondingly, Registrar also has the said power to strike off any defunct LLP -satisfying himself of the need to strike off and having a reasonable cause. Nevertheless, the Registrar has to send a notice to the LLP about his intentions and then request them to send representation within one month from such notice.

The Registrar will publish such notice/content of the application on its website made by the LLP for one month for the information of the general public. Registrar may strike off the name of LLP if no reply is received within the cited period.

B) Winding Up of Limited Liability Partnership

Section 63, Section 64 and Section 65 of LLP Act 2008 govern the process for winding up the LLP in India. It is the process where all the business assets are pre-disposed to meet up the liabilities of the same, and if there is excess, it gets dispersed among the owners. The LLP Act, 2008 provides for subsequent two modes for winding up the LLP, i.e.:

C)Voluntary Winding Up

Under this, the partners may themselves make a decision to stop & wound up the operations of the LLP.

D)Compulsory Winding Up

An LLP may be mandatorily wound up by the Tribunal —

- If the LLP decides that the limited liability partnership be wound up by the Tribunal; –

- If, for a period of more than six months, the number of partners of the LLP is reduced below two;

- If the LLP is unable to pay its debts;

- If the LLP has acted against the interests of the sovereignty and integrity of India, the security of the State or public order;

- If the LLP has made a default in filing with the Registrar the Statement of Account & Solvency or annual return for any five consecutive financial years; or

- When the Tribunal is of the opinion that the LLP be wound up.

Steps to be followed while closing the Limited Liability Partnership:

- Step – 1 – Calling A Board Meeting

LLP will call a Meeting of Partners/Designated Partners for passing a resolution to close the Limited Liability Partnership and to authorize any Designated Partner of the LLP to apply with the Registrar.

- Step – 2 – Setting Off Liabilities

If there are any liabilities in the LLP, it will set off all the liabilities before the next step after passing the resolution.

- Step – 3 – Application To ROC

For removing the name of the LLP under Rule 37(1)(b) & 37(1A) of LLP Rules, an application is made in e-Form 24 to the Registrar with below- mentioned particulars and attachments:

Particulars | Attachments |

Board Meeting of Partners for Closure of LLP | Resolution for Closure of LLP ought to be approved by at least 34 partners. |

Application in e-Form 24 to the ROC for Striking off the name of the LLP with the consent of Partners (Under Clause (b) of sub-rule 1 of Rule 37 of LLP Rules 2008) |

Stopped Business operation for one year or more It complied with Annual Compliance for the period up to its operations. Get the consent of Partners Closure of Bank account Get the consent of Creditors, if any Statement of Assets and Liability shall be prepared certified by a chartered accountant. The authorization of the application by any of the designated Partners. Statement of undertakings or indemnity Bond Acknowledgement of the Latest Income tax return |

Documents Needed with E-Form 24 | An affidavit signed by the partner/ designated partners [according to the format has given sub-clause (b) of clause (II) of sub-rule (1A) to rule 37)]; Copy of the indemnity bond for striking off name Indemnity bond/undertaking Copy of authority to create the application duly signed by all the partners; Copy of acknowledgement of latest ITR. Consent of all the partners and creditors. Statements of accounts revealing nil assets & nil liabilities Application disclosing the reasons for strike off and the operative status of the Company. PAN of LLP Closure Statement of Bank Account |

Documents from Partners & Designated Partners | PAN of Partners of LLP Aadhaar of Partners of LLP Latest Address Proof of Partners of LLP |

- Step – 4 – Surrender PAN of LLP

Once the Certificate of closure of the LLP is received from the Registrar, the partners need to surrender the PAN & TAN of the LLP.

How Dreamunicus Support in Closing LLP

- Purchase a Plan for Expert Assistance

- Add Queries Regarding Closing of an LLP

- Provide Documents to Corpbiz Expert

- Complete all Actions

- Get your work done!

Frequently Asked Questions (Faq)

A 'Limited Liability Partnership', i.e. LLP, is a partnership under which some or all the associates have limited liability.

When the LLP is inoperative from the date of incorporation or inactive for at least one year, and when LLP does not have any assets/liabilities as on the date of application.

In matters where the LLP wants to close down its business or where it is not carrying on any business operations for one year or more, the title of LLP can be struck off by the register or by the LLP in 'e-Form 24' with the consent of all partners.

E-Form 24 is used for producing an application to the Registrar of Companies for striking off the name of the LLP

The LLP must have a PAN, should be inactive for at least one year or non-operational from the time of incorporation, no live bank account at the time of application, and should have filed the latest IT returns.

The designated partners have to sign the application along with the consent of all partners.

Minimum one year has crossed after incorporation of the LLP for making an application for striking off the name of the LLP.

If LLP started operation and closed in between, all returns shall be filed until the date of service of the LLP.

In case business is originated and stopped in between, LLP shall file all Income tax returns till the date of administration. LLPs did not begin service can file closure application without filing returns.

No, once closure request is filed no need to submit any returns.

Free Consultation by Expert

Let us know how to get back to you.

Why Choose Us

We are prominent Tax Consultant in India. We offer services in New Delhi and other major cities in India, like accounts outsourcing, auditing, company formation in India, Business taxation, corporate compliance, starting business in India, registration of foreign companies, taxation of expatriates etc.

- Quality Commitment

- Creative Teams

- Honest & Dependable

- Account Outsourcing

Account Outsorcing

We are a service provider for onsite and offsite Finance & accounting outsourcing services in india. Since 2020, we are continuously helping Startups, Small and Medium Enterprises & businesses (SMEs), and Industries in India to cut costs, improve processes and become more competitive

Quality Commitment

Handling Specialty is dedicated to achieving customer satisfaction through our commitment to providing reliable, maintainable on time; and continually striving to improve our service and quality system.

We Are Creative

We Creative, the premier corporate solution agency in Gurgaon, Delhi NCR, provides high-end solutions to clients in India and overseas. With a highly experienced professional team.

Honest and Dependable

We always keep transparency with our clients, Meeting deadlines is accomplished through proper planning and using work hours effectively.