Due Diligence

An Overview of Due Diligence

Due diligence is an inspection and risk assessment of an upcoming business transaction basically; it is a background check to make sure that the parties to the transaction have the required information they need, to proceed with the transaction. A proper due diligence is required to reveal misrepresentation and fraudulent dealings in a major business transaction.

Due Diligence is the process by which confidential, legal, or financial and other material information are exchanges, reviewed and appraised by the interest parties who are going to enter into a Business transaction. Due diligence often refers to the in-depth research and study being done before signing an agreement or a business with a party.

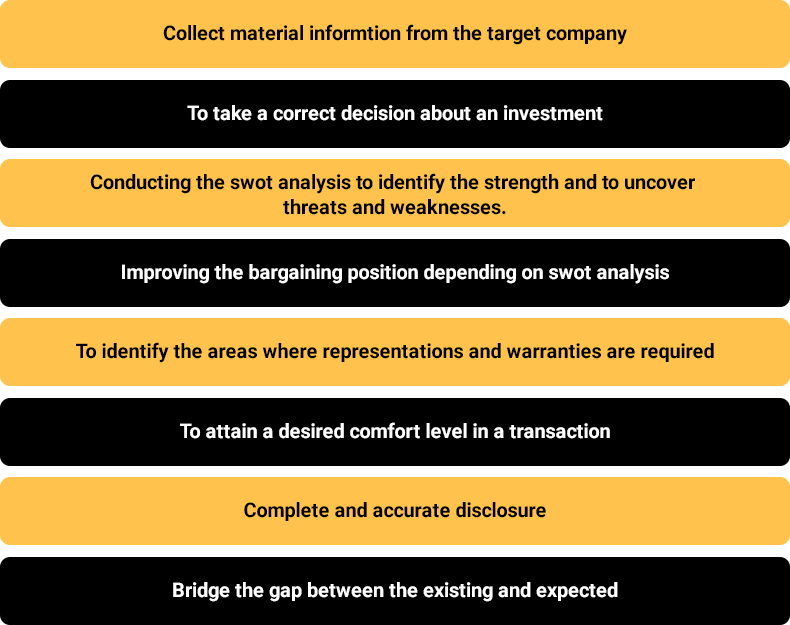

Objective of Due Diligence

The objective of due diligence is to identify problems within the business, particularly those matters which may give rise to unexpected liabilities in the future. The main objectives of conducting Due Diligence are-

When Due Diligence is required?

- Mergers and Acquisitions:

Due diligence is done from the perspective of the seller, as well as the buyer. While the consumer looks into the financials, litigation, patents, and a whole range of relevant information, the seller concentrates on the experience of the buyer, the financial abilities to complete the transaction, and the ability to fulfil responsibilities taken.

- Partnership:

Due diligence is done for necessary alliances, necessary connections, business combinations, and such other alliances.

- Joint Enterprise and Collaborations:

When one company joins hands with another, the reliability of the company is a subject of concern. Assuming the other company’s stand includes the adequacy of supplies at their end.

Other than that, there are certain transactions that requires proper Due Diligence-

- Strategic Alliance

- Business Coalitions

- Outsourcing Agreement

- Technology or Product Licensing

- Joint venture through technical or financial Collaboration

- Venture Capital investment

- Public Issue.

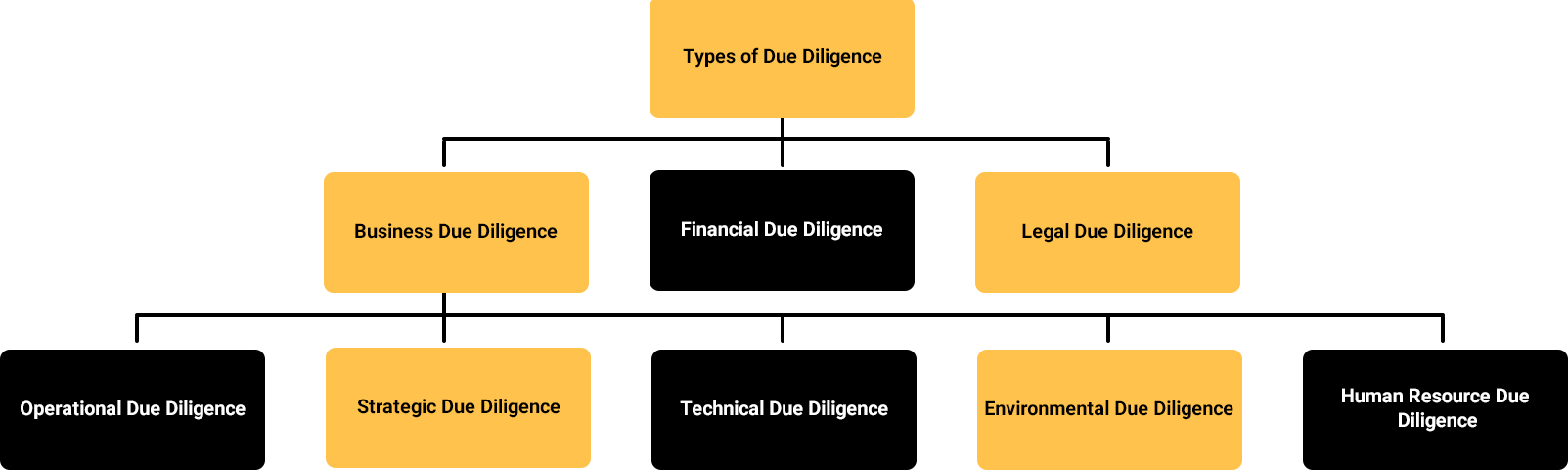

Types of Due Diligence

Due Diligence – Focused Area

Below mentioned are the key factors to be kept in mind while conducting Due Diligence-

- Clear about the party’s expectation in terms of business revenue, profits, and the profitability of the target company.

- To examine whether the related parties have resources to make the business succeed. Also, whether the party are willing to put in all the hard work required for the new venture.

- Consider whether the business gives concerned party the opportunity to put the skills and experience to good use.

- The concerned parties must also focus on Competitors and Industries, valuation multiples, Management and ownership, and risk factors.

Benefits of Due Diligence

Due diligence is needed so that the entity is well conscious of all the essential items like:-

- Administration and Ownership

Analysis of who runs the Company

- Capitalization

Examining how large and volatile is the Company and market. A contrastive analysis of both of them is needed.

- Business Competitors and Industries

Research and compare the boundaries of competitors for a better comprehension of the target Company

- Balance Sheet Review

This helps in interpreting the debt-to-equity ratio.

- Revenue, Profit and Margin Bearings

To examine if there are any recent trends in the figures which may be rising, falling or stable?

- Risks

It enables to learn industry-wide and Company-specific dangers, and all the checking if there are any on-going risks and trying to predict any futuristic unforeseeable threats in the future.

- Capital History/Options and Probabilities

How long has the Company been dealing? For a short- term or long-term? Has there been a steady stock price?

- Expectations

To maximize the profit for the future.

Documents required for Processing Due-Diligence

During Due-Diligence Process, the following types of documents are required to be checked-

- Basic information of the company

- Financial Data

- Important Business Agreements

- Intellectual Property Right details

- Litigation Aspects

- Marketing Information

- Internal Control check system

- Taxation aspects

- Insurance Coverage

- Environmental Aspects

- Human Resource Aspects

- Cultural Aspects.

Procedure Involved in the Due Diligence Process

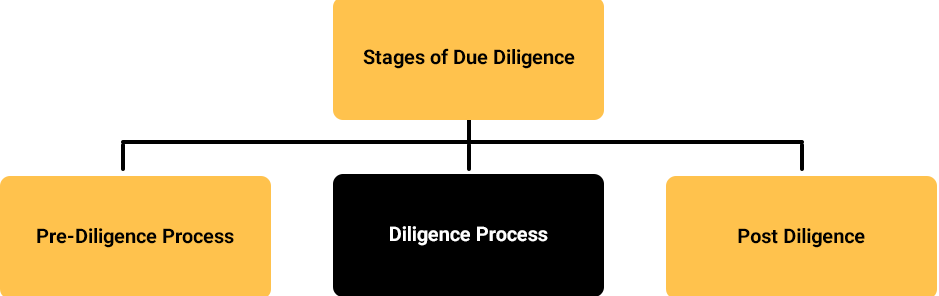

There are 3 stages in the Due diligence process-

I. Pre-Diligence Process

Pre-Diligence Process is the initial step for Due diligence process and is primarily the activity of management of documentation and people.

- Firstly, the investor has to sign the Letter of Intent and the Non-Disclosure Agreement with the Target Company.

- Receiving the document from the company and review of the same with the checklist of documents already submitted to the company.

- Recognizing the issues.

- Arranging the documents required for a Diligence.

- Creating a Data Room.

What is Reliable Data Room?

A Data room discloses confidential data which is not available for public and may relate to business process, trade secret, technology information etc. It provides all important business documents which may be on financial, regulatory, Intellectual Property right, marketing or any important material aspect pertaining to a business transaction. Data Room is the standard manner to use a ‘virtual data’ room addressing the issue of confidentiality. Nevertheless, we reserve the right to demand as per need. Admittance to the data room will frequently be for a limited duration and may get concentrated on a small number of personalities at any one time. The ‘data room’ will include all information comparing to the purpose of investment.

II. Diligence Process

After the Diligence, is conducted, the professional submits the report, known as Due Diligence Report.The Due diligence report can of various kinds-

- Summary Report.

- Detailed Report

Also, the outcome of the Due Diligence Report can be of various kinds-

- Deal Breakers

In this type of report, the outcome can be very glaring and may uncover various non-compliances that may arise i.e. Any criminal proceedings or known liabilities.

- Deal Diluters

The outcome arising out a diligence may contain violations which may have ab impact in the form of quantifiable penalties and as consequence may result in diminishing the value of company

- Deal Cautioner

Deal cautioners cover those findings in a diligence which may not impact the financials , but there exists confirmed non-compliances which though fixable,require the investor to step a cautious path.

- Deal Makers

Deal Makers are very hard to come by and may not be a fact in the literal sense ,In these reports the diligence reports team have not been able to come across any violations, leading them to submit a ‘ Clean Report’.

Due Diligence Report

The information collected during this process is essential for decision making and hence needs to be announced. Once the Due diligence, is conducted the professionals submits a report, which in spoken language is termed as “THE DUE DILIGENCE REPORT”. The Due Diligence report helps in explaining how the company plans to generate further earnings (monetary as well as non-monetary). It works as a ready reckoner for explaining the state of affairs at the time of purchase/sale, etc. The ultimate objective is to get a clear understanding of how the business will perform in the future.

III. Post Diligence

Post Diligence results in rectification of non-compliances found during the course of Due-Diligence. Post Due diligence is the interesting process arising out of the diligence made by the team of experts.The process includes making the application, filing the petition for compounding of offenses, or negotiating the shareholder’s agreement. Post diligence process helps the investor in negotiating the deal.

Techniques of Due Diligence process and Risk Assessment

Due Diligence and risk assessment are the key essentials before entering into any new business. Below mentioned are the techniques of Due Diligence and Risk Assessment.

- Analyze the Capitalization

A business’s market capitalization, or total value, registers how active the stock price is, how broad its title is, and the potential size of the company’s destination markets.

- Resources Acquisition, And Margin

The company’s income report will list its revenue or its net income or profit. It’s necessary to monitor trends over time in a business’s revenue, operating expenditures, profit edges, and return on investment.

- Rivals Comparative Study

Every business is determined in part by its opponent. Examine the profit margins of two or three of its competitors. Performing due diligence on several businesses in the same industry can give an investor tremendous insight into how the company is performing and what activities have the leading edge in it.

- Valuation Multiples

Various ratios and economic metrics are used to estimate companies. Still, three of the most valuable are the ‘price-to-earnings’ (P/E) ratio, the ‘price/earnings to growth’ (PEGs) ratio, and the ‘price-to-sales’ (P/S) ratio.

- Administration and Share Ownership

Is the company still run by its originators, or has the board rearranged in a lot of new features? Fresher companies serve to be founder-led. Research the bios of executives to find out their level of expertise and knowledge.

- Balance Sheet

The organization’s consolidated balance sheet will show its assets and liabilities, as well as how substantial cash is possible. It ascertains the debt-to-equity ratio to see how much tangible equity the company has.

- History of Stock Costing

Investors should examine both the ‘short-term’ and ‘long-term price’ movement of the stock and whether the capital has been animated or steady. It connects the profits created historically and determine how it interacts with the price movement.

- Stock Suspension

It should get researched upon how many shares exceptional the company has and how that number relates to the competition. Is the company representing on issuing more shares? If so, the stock price might get a hit.

- Examine Long and Short-Term Risks

Be sure to understand both the industry-wide risks and company-specific risks. Are there outstanding legal or regulatory matters? Is there unsteady management?

• Strategy

• Target Credentials

• Non- Disclosure Agreement

• Estimation

• Creation of Data Room

• Letter of Intent

• Due Diligence

• Deal Construction

• Conducting the SWOT analysis and Negotiation by the investors

• Contracts & Share Purchase Agreement

• Post Due Diligence Process and its compliances

- Strategy

- Target Credentials

- Non- Disclosure Agreement

- Estimation

- Creation of Data Room

- Letter of Intent

- Due Diligence

- Deal Construction

- Conducting the SWOT analysis and Negotiation by the investors

- Contracts & Share Purchase Agreement

Differences between Due Diligence and Statutory Audit

In India, companies statutorily required to get their accounts audited by an unconventional Chartered Accountant. In some cases, companies needed to carry out an internal audit relating to their method. Due diligence is quite distinct from statutory audits. The difference between Due Diligence and Statutory Audit is given below:-

S.No | Statutory Audit | Due Diligence |

1. | Limited to Financial Analysis

| It not only includes the financial analysis but also includes Business plan, sustainability of business, future aspects, corporate and management prospects, legal issues, etc. |

2. | Based on Historical Data | Covers future growth prospects in addition to the historical data. |

3. | Statutory Audit is Mandatory. | Due Diligence is mandatory based on the transaction. |

4. | Provides Positive Assurance | Negative Assurance |

5. | Post-Mortem Analysis | Required for Future Decisions |

6. | Statutory Audit is always Uniform | Due Diligence varies according to the nature of transaction |

7. | The audit is recurring event | Occasional Event |

Tax Outline: Perspective on Due Diligence

Tax due diligence represents a prominent role in M&A determination; however the tax usually is not the primary concern in the context of M&A deals. Customarily, tax due diligence is carried out to explain more about the tax profile of the target and to reveal and quantify any tax exposures. Nevertheless, tax due diligence also comprises recognizing any tax upsides which may be accessible to the goal. It also supports in distinguishing and developing an appropriate procurement structure for the deal in question. The buyer needs to consider while negotiating for the tax protection to ensure that it does not affect the commerciality of the business for the seller. A tax due diligence is traditionally taken out to:

- Verify the descriptions made by the seller at the time of pre-deal discussions concerning tax matters.

- Verify the tax assumptions presented by the buyer in valuing the target.

- It is distinguishing any material tax publications that may be remaining with the target, including ill symptoms of such tax exposures.

- Recognize any material upsides such as possible tax benefits that are being maintained by the end.

- Structure the venture in a tax-efficient practice.

- Evaluate the availability of tax losses, tax credits, and other tax assets.

- Guarantee the adequate protection mechanism for the buyer.

Dreamunicus Support

Dreamunicus Conducts Inquiries, Data Rooms, and Searches for Due Diligence Surveys. We help our clients in preparing the questionnaire, Conducting Interviews with Beneficiary Management, Preparing Internal and External Public Registers. We provide various services related to Due-Diligence.

Questionnaire

- On instruction, we will present a due diligence questionnaire to the investment recipient, which is intended to extract all relevant material data about the target investment.

- The questionnaire is customarily based on a specific pro forma but will be tailored to the particular business and sector. The investment recipient’s lawyers will continually coordinate the acknowledgments to the questionnaire, with specialist lawyers/advisers dispensing with answers appropriate to their area. It is also common practice that in a lot of cases the directors and senior administrators may compile and present this information to us. ,

Interviews with Beneficiary Management

Even as the administration is always best placed to present this information on the target’s enterprise and prospects, we likewise will be handling management interviews, as we see this as an indispensable part of our ‘due diligence’ process.

Internal and External Public Registers

Public records may, though, not be entirely up to date, and this will form part of our crosschecking structure everywhere the due diligence inquiries. External explorations are not confined to:-

- Examinations where the target, investment recipient of the investment recipient’s guarantor is a company,

- Organizations registrar records, Bankruptcy and Court records,

- Wherever the guarantor or the target partner is an individual, a research of the ‘Individual Insolvency Register’ for current and fresh bankruptcies, current individual voluntary compromises, debt relief orders, and current bankruptcy limitations orders and projects,

- The records of trademarks, patents and recorded/certified designs prepared by Intellectual Property Offices,

- Land registrar searches,

- Commercial learning providers such as Dun & Bradstreet,

- The target’s websites and extensive searches of the goal through an internet hunt and any other genuine searches and information requests.

Why Dreamunicus?

Because We Consist Of

- Stamina energy, and confident of resolving issues and working as per timetables and deadlines

- Commercial Recognition combined with practical experience and an interrogative mind

- Identify Key Drivers to ensure a concentrated approach, be alert to problem areas and inequalities

- Presentation Personal skills and an ability to express clearly, and without ambiguity

- Related Expertise to provide targeted and useful due diligence feedback that adds value the business.

Frequently Asked Questions (Faq)

The Whys are as follows

- Evaluation and structuring of the transaction

- Confirm/verify representations and warranties

- Validate Business Plan

Transaction Management

- Business Due Diligence:

- Legal Due Diligence

- Financial Due Diligence:

- People Due Diligence

- Environmental Due Diligence

- Due Diligence Advisory

The Pillars are Decisive Rationale, Risk Reduction, and Post-Diligence

The Benefits of Due Diligence are as Follows.

- Determine Administration and Ownership

- Determine Capitalization

- Analyse Business Competitors and Industries

- Balance Sheet Review

- Revenue, Profit and Margin Bearings

- Risks Managements

- Expectations Review

- Capital history/options and Probabilities

- Analyze the Capitalization

- Resources Acquisition, and Margin

- Rivals measurement

- Comparative Study

- Valuation Multiples

- Administration and Share Ownership

- Balance Sheet

- History of Stock Costing

- Stock Suspension

- Expectations

- Examine Long and Short-term Risks

It is a standard manner to use a 'virtual data' room addressing the issue of confidentiality. Nevertheless, you can reserve the right to demand as per need.

Public records may, though, not be entirely up to date, and this will form part of our crosschecking structure everywhere the due diligence inquiries.

In India, companies statutorily required to get their accounts audited by an unconventional Chartered Accountant. In some cases, companies needed to carry out an interior audit relating to their method. Due diligence is quite distinct from internal and statutory audits.

- Identification and mitigation of risks in light of market practice and legal requirements

- Changes in the structure of the transaction

- Price adjustment

- Conditions precedent

- Representations and warranties

- Verification of disclosures

- Retention of the purchase price

- Indemnity

- Conditions after closing the deal.

The emphasis of due diligence into areas of human resources should be on:

- Compliance with employment laws;

- Employee contracts;

- Employment-related liabilities (such as redundancy payments and social taxes);

- Other issues are likely to be outlined in a due diligence checklist.

Free Consultation by Expert

Let us know how to get back to you.

Why Choose Us

We are prominent Tax Consultant in India. We offer services in New Delhi and other major cities in India, like accounts outsourcing, auditing, company formation in India, Business taxation, corporate compliance, starting business in India, registration of foreign companies, taxation of expatriates etc.

- Quality Commitment

- Creative Teams

- Honest & Dependable

- Account Outsourcing

Account Outsorcing

We are a service provider for onsite and offsite Finance & accounting outsourcing services in india. Since 2020, we are continuously helping Startups, Small and Medium Enterprises & businesses (SMEs), and Industries in India to cut costs, improve processes and become more competitive

Quality Commitment

Handling Specialty is dedicated to achieving customer satisfaction through our commitment to providing reliable, maintainable on time; and continually striving to improve our service and quality system.

We Are Creative

We Creative, the premier corporate solution agency in Gurgaon, Delhi NCR, provides high-end solutions to clients in India and overseas. With a highly experienced professional team.

Honest and Dependable

We always keep transparency with our clients, Meeting deadlines is accomplished through proper planning and using work hours effectively.